Subscription cancellations hurt your revenue more than you think. Losing even a single subscriber means losing months or years of potential payments.

For WooCommerce businesses, churn rates can be as high as 10% monthly, and payment failures alone account for up to 33% of these losses. But here’s the good news: most cancellations are preventable.

Key Reasons Customers Cancel:

- Payment Failures: Expired cards and failed transactions lead to involuntary churn.

- Perceived Low Value: Customers leave if they feel the service isn’t worth the cost.

- Rigid Policies: Inflexible cancellation or plan options push users away.

- Poor Communication: Lack of timely updates or support can erode trust.

Solutions That Work:

- Automated Payment Recovery: Retry failed payments and send reminders.

- Flexible Subscription Options: Let customers pause, downgrade, or adjust plans.

- Retention Offers: Discounts or incentives to address cost concerns.

- Cancellation Surveys: Gather feedback to improve and reduce future churn.

By addressing these issues proactively and using tools like WPSubscription for automation and customer control, you can reduce churn and build steady revenue. Start focusing on keeping your subscribers today.

Ecommerce Subscription Masterclass: How to Fix Your Churn and Get to High LTV

Why Customers Cancel Their Subscriptions

To build a stronger subscription business, it’s crucial to understand why customers decide to leave. While the reasons can vary, four common challenges often lead to cancellations. Each requires a focused approach to be addressed effectively.

Payment Failures and Expired Cards

Sometimes, cancellations happen without the customer even intending to leave – this is known as involuntary churn. It can occur when payments fail due to expired cards, maxed-out credit limits, or processing errors.

Even satisfied customers can lose access to a service simply because their billing details weren’t updated in time. These situations highlight the importance of proactive measures to minimize payment disruptions.

Next, let’s look at how customers’ perception of value impacts their decision to stay.

Customers Don’t See Enough Value

When customers feel they aren’t getting enough value for what they’re paying, cancellation becomes almost inevitable. For instance, a fitness app subscriber might stop using the service if they shift their focus to outdoor activities.

Similarly, if a software subscription no longer meets a business’s evolving needs – or if a competitor offers better features at a similar price – customers may decide it’s not worth the cost.

Even small price increases can lead to cancellations, especially if subscribers rarely use the service. The bottom line? When engagement drops, so does the perceived value. Policy flexibility also plays a big role in retention.

Inflexible Cancellation and Plan Policies

Rigid policies can frustrate customers and push them to cancel. Many subscribers appreciate options like pausing their membership during financial hardships or seasonal downtimes instead of canceling outright.

If a service doesn’t offer flexible alternatives – like the ability to downgrade to a cheaper plan – customers may feel they have no choice but to leave, even if they still find some value in the service. Complex cancellation processes only add to the frustration, leaving a negative impression.

For example, research from Recurly shows that giving customers the option to skip a renewal can increase retention by up to 10%. Additionally, billing cycles that don’t align with customer preferences can further drive cancellations.

Finally, communication – or the lack of it – can be a dealbreaker.

Poor Customer Communication

When communication falls short, cancellations often follow. Generic or poorly timed messages fail to resonate, leaving customers feeling disconnected from the service.

For example, if customers aren’t notified about upcoming renewals, billing changes, or new features, unexpected surprises can erode their trust. Proactive, meaningful communication is key to keeping customers engaged.

On the flip side, slow or unhelpful responses to customer inquiries can turn minor frustrations into major reasons to cancel. Clear, timely, and value-driven interactions are essential to maintaining strong relationships with subscribers.

How to Spot Customers Who Might Cancel

Catching signs of cancellation early can make all the difference in retaining subscribers. The trick is knowing what to watch for and having systems in place to track key indicators.

By keeping an eye on specific metrics, gathering customer feedback, and noticing changes in behavior, you can identify at-risk subscribers and take action before they leave. Here’s a closer look at the tools and signals to monitor.

Monitor Key Subscription Metrics

Tracking the right metrics – MRR, churn rate, and CLV – can reveal patterns that highlight potential problems in your subscription model.

- MRR (Monthly Recurring Revenue): This metric reflects your total predictable revenue each month. Calculate it by multiplying the number of active subscribers by the average monthly price.

For example, 1,000 subscribers paying $20 per month would result in an MRR of $20,000. Watch for sudden drops or slower growth, as these could point to underlying issues. - Churn Rate: This measures the percentage of customers who cancel during a specific time frame. To calculate, divide the number of cancellations by the initial subscriber count, then multiply by 100.

The average monthly churn rate in most industries ranges from 5% to 10%, but companies at the top of their game aim for less than 5%. - CLV (Customer Lifetime Value): CLV estimates the total revenue a customer will bring over their subscription lifespan. Multiply the average monthly revenue per customer by their average subscription duration. For instance, with a 5% churn rate, the average customer stays for 20 months, creating a CLV of $400 per customer.

By analyzing these metrics together, you can get a clear picture of your subscription health. For example, if your MRR is dropping but your subscriber count remains steady, it might mean you’re losing higher-paying customers.

If CLV is on the decline, it’s time to focus on strategies to keep customers around longer.

Collect Feedback Through Cancellation Surveys

When a customer cancels, it’s an opportunity to learn why – and how you can improve. Exit-intent surveys capture this feedback at just the right moment, offering insights that can help prevent future cancellations.

For example, WooCommerce stores can use survey pop-ups during the cancellation process. These surveys often include multiple-choice questions with reasons like “too expensive”, “found a better alternative”, “not satisfied with quality”, or “no longer need the product”.

The most effective surveys combine multiple-choice questions with open-ended ones. Start with quick, simple options to identify the main reason, then follow up with questions like, “What could we have done differently?” This approach encourages detailed responses, helping you uncover specific issues to address.

Survey responses are typically saved in subscription order notes, creating a useful record for analysis. Many plugins also offer built-in analytics to track top cancellation reasons and measure the effectiveness of retention offers.

For example, if 40% of your cancellations cite pricing concerns while 30% mention dissatisfaction with the product, you’ll know exactly where to focus your efforts.

Warning Signs That Customers Might Leave

Certain behaviors can signal that a customer is at risk of canceling. Recognizing these early allows you to step in before it’s too late. The most common warning signs fall into three categories: usage patterns, payment issues, and engagement drops.

- Reduced Usage: If a customer hasn’t logged in or used their subscription benefits for several months, it’s a big red flag. This is especially true for digital services, where engagement often equals perceived value.

- Payment Issues: Problems like declined transactions or expired cards should be addressed immediately.

- Low Engagement: Customers ignoring renewal reminders, promotional emails, or product updates may already be mentally checking out. Track individual email open rates and click-through rates to spot those becoming unresponsive.

| Warning Sign | What to Watch For | Action Timeline |

|---|---|---|

| Reduced Usage | No logins for 30+ days, unused benefits | Immediate action |

| Payment Issues | Declined transactions, expired cards | Within 24-48 hours |

| Low Engagement | Unopened emails, ignored reminders | Weekly monitoring |

Setting up automated alerts for these behaviors ensures you don’t miss critical signs. If a customer shows multiple risk factors – like reduced usage and a payment issue – make them a priority for retention efforts. The sooner you act, the better your chances of keeping them on board.

How to Reduce Subscription Cancellations

Cutting down on subscription cancellations means identifying customers at risk, tackling the root causes, and using strategies like automated payment recovery, flexible subscription management, and tailored retention offers.

Set Up Automatic Payment Recovery

Failed payments are a major reason people cancel subscriptions. In fact, up to 33% of annual subscriptions can be lost to payment issues if left unchecked. That’s a huge chunk of revenue slipping away.

The good news? Automated payment recovery systems can step in to fix this. When a payment doesn’t go through, these systems automatically retry the transaction and send reminders to customers to update their billing info.

A solid setup includes automatic retries, personalized notifications for customers, and alerts for administrators to act quickly.

For example, WPSubscription simplifies this process by notifying users of failed payments and automatically retrying transactions based on WooCommerce’s built-in retry rules.

Administrators also get alerts, allowing them to step in before customers give up and cancel.

Businesses that use automated retry systems and reminders often see a big difference – reducing involuntary churn by as much as 30%. It’s a simple yet effective way to keep customers on board.

But payment recovery is just one piece of the puzzle. Giving customers more control over their subscriptions is equally important.

Give Customers More Control Over Their Subscriptions

People are more likely to stick around if they feel in charge of their subscriptions. Self-service management tools make a huge difference here.

When customers can pause, skip a renewal, or adjust their plan without reaching out to support, they’re far less likely to cancel. In fact, allowing customers to skip a renewal rather than cancel altogether can boost retention by up to 10%.

Some valuable self-service features include:

- Upgrading or downgrading plans

- Changing billing frequency

- Temporarily pausing subscriptions

- Updating payment details

Another big win is giving customers the option to choose how their renewals work – whether automatic for convenience or manual for better budget control.

These features not only make customers happier but also cut down on support requests and cancellations. Adding perks like early renewal options can also ensure customers don’t experience service interruptions while maintaining steady revenue flow.

Offer Discounts and Incentives to Stay

Sometimes, a well-timed offer can make all the difference. When customers are about to cancel, presenting a targeted retention offer can address their concerns and encourage them to stay.

For example, if cost is the issue, a temporary discount might make the subscription more affordable. Other incentives, like bonus features or extended trials, can also add value and change their minds.

Using cancellation surveys is another smart move. These surveys can uncover why customers are leaving, allowing you to craft offers that directly address their reasons.

For instance, a pop-up survey during the cancellation process can provide insights and present alternatives at just the right moment.

The best retention strategies combine multiple tactics. Instead of just offering a discount, you could pair it with an option to pause the subscription temporarily. This approach shows customers you’re willing to work with them to find a solution.

To make your retention efforts even stronger, keep track of how well your offers are working. Monitor which offers successfully prevent cancellations, see how long retained customers stay, and tweak your strategy based on their feedback.

Over time, these insights will help you fine-tune your approach and keep more customers engaged.

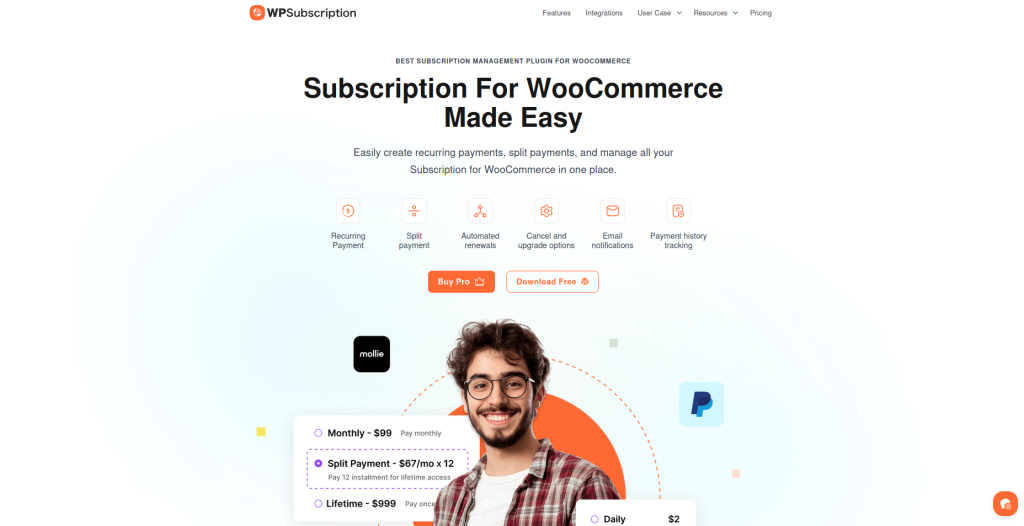

Using WPSubscription to Prevent Cancellations

WPSubscription tackles common issues like payment failures, limited customer control, and rigid subscription plans. This WooCommerce plugin offers tools that help store owners keep their subscribers engaged and reduce churn.

Automatic Renewals and Multiple Payment Options

Automating renewals significantly cuts down on payment failures. WPSubscription handles recurring payments and integrates with several payment gateways, including Stripe, PayPal, and Paddle. This variety gives customers the freedom to choose how they pay.

“The plugin will automatically notify the user and retry the payment according to WooCommerce’s retry rules. You’ll also be notified of any issues.”

This feature is especially useful in the U.S., where customers often switch between cards or payment methods.

By offering multiple gateways, WPSubscription ensures customers have backup options when their default payment method doesn’t work. Stores using diverse payment options have seen an 8% boost in retention rates.

But WPSubscription doesn’t stop at automating payments – it also gives customers more control over their subscriptions.

Let Customers Manage Their Own Subscriptions

WPSubscription empowers users with self-service tools, allowing them to upgrade, downgrade, or cancel subscriptions directly from their dashboard.

Customers can also choose between automatic renewals for convenience or manual renewals for better budget management. This flexibility helps reduce cancellations caused by frustration with rigid billing cycles.

One satisfied user shared:

“I love how easy it is to use the Subscriptions for WooCommerce plugin. I set up my product plans in just a few minutes and my customers can manage everything on their own.” – Emily Richmond

Another standout feature is early renewal, which allows customers to renew their subscriptions anytime before the next billing cycle.

This ensures uninterrupted service and gives users greater control over their payments. Businesses using this feature have reported up to a 15% reduction in churn rates.

These self-service options are further enhanced by flexible subscription plans.

Create Flexible Subscription Plans

Flexibility in subscription plans plays a key role in reducing cancellations. WPSubscription lets store owners design subscription products with adjustable billing intervals, free trials, and split payment options to meet diverse customer needs and budgets.

Split payments are especially helpful for higher-priced subscriptions, offering customers the ability to pay in installments – whether weekly, monthly, or on a custom schedule.

Free trials allow hesitant customers to try the service before committing, lowering the risk of early cancellations.

For customers at risk of canceling, the plugin supports customizable renewal pricing. Store owners can offer targeted discounts or special renewal rates to address cost concerns.

For instance, a U.S.-based fitness app retained 28% of subscribers who were about to cancel by offering a 20% discount for three months. This strategy brought in an additional $42,000 in recurring revenue over six months.

WPSubscription also aligns with local preferences, supporting U.S. currency formatting (e.g., $49.99/month), standard American date formats (MM/DD/YYYY), and payment practices, making it a strong fit for WooCommerce stores in the U.S.

Here’s a quick overview of how WPSubscription helps reduce cancellations:

| Feature | How It Prevents Cancellations | Example Impact (U.S.) |

|---|---|---|

| Automatic Renewals | Reduces payment failures/involuntary churn | +12% renewal rate |

| Multiple Payment Gateways | Increases successful payments | +8% retention |

| Customer Self-Service | Empowers users, reduces support burden | -15% churn |

| Flexible Plans & Discounts | Addresses cost/value concerns | +20-30% retention (with offer) |

Which Retention Methods Work Best

Retention strategies deliver varying results, so it’s essential to focus on approaches that bring the greatest return on investment.

One effective method is automated payment recovery, which tackles involuntary churn by addressing failed payments.

Another is self-service options, which give customers the freedom to manage their subscriptions, reducing frustration and preventing cancellations.

For price-sensitive customers, targeted offers, like discounts or skip-renewal options, can address cost concerns when applied thoughtfully. Lastly, cancellation surveys provide valuable insights to refine your retention tactics.

Here’s a quick breakdown of these strategies:

Retention Strategy Comparison

| Retention Strategy | Benefits | Drawbacks | Ideal Use Cases | Expected Impact |

|---|---|---|---|---|

| Automated Payment Recovery | Reduces involuntary churn and recovers lost revenue with minimal effort | Requires initial technical setup; may not recover all failed payments | High-volume stores, recurring billing models | Prevents up to 33% annual churn |

| Self-Service Options | Empowers customers, reduces support tickets, and boosts satisfaction | Implementation can be complex; potential misuse (e.g., frequent pauses) | Memberships, SaaS, digital products | Significant retention improvement |

| Skip/Pause Subscription | Retains customers needing temporary breaks; simple to implement | May delay revenue; not suitable for all products | Seasonal products, discretionary services | Up to 10% retention increase |

| Targeted Offers/Discounts | Provides immediate incentives to stay and addresses cost concerns | Can reduce short-term revenue; requires precise targeting | Price-sensitive customers, high churn segments | Varies based on offer and timing |

| Cancellation Surveys | Delivers actionable feedback for future improvements | Requires analysis and follow-up; doesn’t prevent immediate churn | All subscription models | Enables data-driven retention |

To maximize retention, it’s often best to combine multiple strategies. Start with automated payment recovery to reduce involuntary churn.

Then, enhance customer satisfaction by offering self-service options. Finally, address voluntary cancellations with targeted offers and actionable insights from cancellation surveys.

For WooCommerce store owners, tools like WPSubscription’s payment history and subscription overview features can help track the success of these retention strategies.

This data allows you to fine-tune your approach, tailoring it to your customer base for better results.

Conclusion: Keep More Customers and Grow Your Business

Keeping cancellations in check is all about building a business that thrives on loyal customers. The key? Shifting your focus from reacting to churn to actively preventing it.

When you understand why customers leave – whether it’s due to payment failures (which account for nearly 33% of annual subscriptions), a lack of perceived value, or rigid policies – you can tackle those issues head-on. These insights pave the way for strategies that keep customers engaged and satisfied.

A winning retention strategy combines tools like automated payment recovery, self-service options, targeted offers, and cancellation surveys.

Together, these methods address both involuntary and voluntary churn, all while giving you a clearer picture of what your customers truly need.

For WooCommerce store owners, WPSubscription makes managing subscriptions easier than ever. With automated renewals, multiple payment gateways, flexible billing schedules, and user-friendly dashboards, it ensures your retention efforts are effective at every step of the customer journey.

Success in the subscription economy isn’t a one-and-done effort – it’s an ongoing process. By continuously gathering feedback, tracking key metrics, and adapting your offerings, you’ll not only boost revenue but also keep your customers happy and coming back for more.

FAQs

What steps can businesses take to reduce payment failures and avoid subscription cancellations?

To cut down on payment failures, businesses can use automated billing systems that work seamlessly with trusted payment gateways like Stripe, PayPal, or Paddle. These tools help ensure recurring payments are processed efficiently and on schedule.

On top of that, giving customers flexible billing options and sending advance payment reminders can go a long way in reducing failed transactions.

Tackling these issues proactively helps businesses retain customers and keep subscription revenue flowing steadily.

How can I enhance the perceived value of my subscription services to reduce cancellations?

To make your subscription service stand out, the key is to create an experience that feels both seamless and rewarding.

Show customers why your service is worth it by emphasizing its standout perks – things like exclusive features, tools that save time, or how it offers better cost savings compared to other options.

Keep these benefits top of mind for your customers by sharing updates through emails, newsletters, or in-app notifications. These reminders help reinforce the value they’re getting.

Offering flexible billing options can also make a big difference. Think monthly and annual plans, free trials to let them test the waters, or customizable subscription tiers that fit different needs.

On top of that, giving customers access to self-service tools – like the ability to skip a billing cycle or easily upgrade their plan – can boost satisfaction and keep them around longer.

If you’re running a WooCommerce store, tools like WPSubscription can make managing subscriptions much simpler. This plugin helps you put these strategies into action while maintaining a smooth and hassle-free experience for your customers.

How can I reduce involuntary subscription cancellations by automating payment recovery in my WooCommerce store?

To cut down on unwanted subscription cancellations, tools like WPSubscription can be incredibly helpful. They enable you to set up automated systems that handle payment recovery smoothly across various gateways, such as Stripe, PayPal, and Paddle.

Features like automated retries for failed payments and reminders about upcoming charges make it easier to keep payments on track.

Plus, WPSubscription offers self-service options for customers to update their payment details, which can go a long way in boosting retention and minimizing churn.